NEW YORK (Reuters) - Regular interest-rate hikes are needed to avoid overheating a U.S. economy in which inflation is only temporarily weak and unemployment is headed yet lower, a Federal Reserve policymaker said on Wednesday.

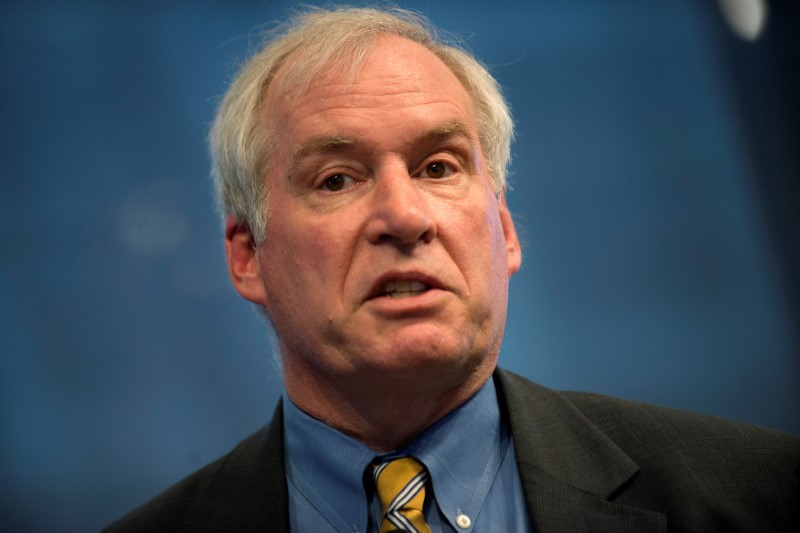

Reinforcing the hawkish group of policymakers in the U.S. central bank, Boston Fed President Eric Rosengren brushed off concerns among some of his colleagues that inflation readings have drifted further below the Fed's 2.0-percent target this year to 1.4 percent.

He instead highlighted the risk of halting a series of gradual rate rises, calling the policy tightening "appropriate risk mitigation" in the face of possible dangerous spikes in inflation or asset prices that could halt the recovery.

The economy "risks pushing past what is sustainable," so taking steps to avoid that "seem(s) like insurance worth taking out at this time," said Rosengren, who does not have a vote on policy this year but whose policy advice has proven prescient over the last several years.

"Regular and gradual removal of monetary accommodation seems appropriate," he told the Money Marketeers bond traders group in New York. "Policymakers should not overreact to low current inflation readings that are widely expected to be temporary."

Based on forecasts published last week and Fed Chair Janet Yellen's speech on Tuesday, the central bank's core decision makers appear to agree with Rosengren that inflation should rebound. Traders give a December rate hike about 65-percent odds, according to Reuters data.

Rosengren said he was not bothered that inflation weakness could remain until spring of next year. He expects the Fed's preferred price measure to rise through the end of 2018, while unemployment, at 4.4 percent, to fall further below a sustainable level.

Meanwhile, he said, the effects of the hurricanes that have battered the country over the last month will "significantly cloud" economic data over the next while, complicating things for the central bank.

No comments:

Post a Comment